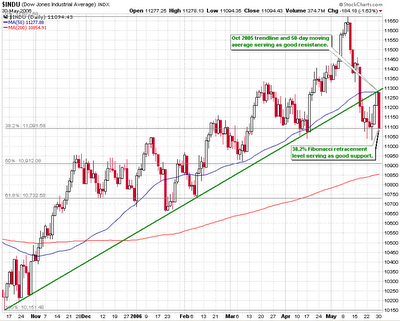

Perhaps due to the approaching Memorial Day holiday weekend, the three day rebound of the sell-off occurred on declining volume. Friday closed within the proximity of the 50-day moving average, the Oct 2005 trendline and 38.2% Fibonacci advancement from the sell-off low. Prior trendlines which become violated usually serve as new resistance, and if the Street doesn’t like this week’s data on manufacturing, employment growth and worker productivity, then this could be a good entry point for shorts. Otherwise, the next level of resistance looks to be around 11,350; this is a 50% Fibonacci advancement from the sell-off low and coincides with a 20-day moving average Bollinger Band centre.