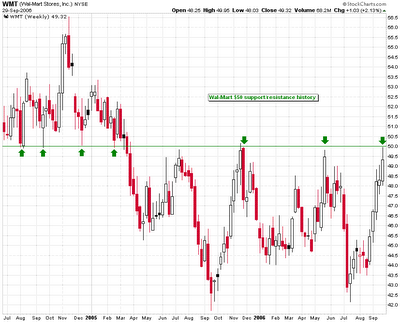

Over the last 28 months, the $50 level for Wal-Mart has served as defining resistance and support levels of bull versus bear. With current price action again hitting this $50 level as resistance and RSI and stochastics overbought, now be a good entry into a short position; -adding to the position on break and close below the uptrend. Stop loss: break and close above $50.