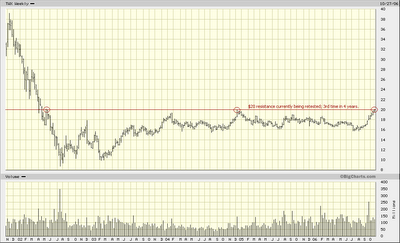

Media and entertainment company, Time Warner, has rallied some 20% since summer and is now approaching a crucial $20 level. This is the third time in 4 years $20 has been tested, serving as resistance twice before. Short-sell now for a possible price target towards the primary uptrend support of the summer rally. Stop-loss: close above $20. Go long on close above $20.

Technical Analysis of Financial Markets

Sunday, October 29, 2006

Friday, October 27, 2006

Texas Instruments, Inc. (TXN) - Head & Shoulders

Texas Instruments seems like it has formed a possible bearish Head & Shoulders top pattern. Neckline support at $31 was broken on Tuesday when the chipmaker announced disappointing sales. A current retest of the Neckline is serving as resistance. Enter short-sell position now near $31 for a possible price target towards a Gap support at $28.50 or a Gap fill at $28. Stop-loss: close above $31.

Sunday, October 15, 2006

Infosys Technologies Ltd. (INFY)

Indian technology services, consulting and IT outsourcing firm Infosys, continued on Wednesday to announce profit and revenue surpassing analysts' projections; revising its guidance higher. However, the recent 62% gain in price action over a 4-month rally is starting to look overbought. A crossover of stochastics may serve as an entry into a short position for a price target towards the uptrend support; adding to the position on close below the trendline. Stop loss: close above $53.50. On Thursday, Jefferies reiterated a Buy rating with a $57 target.

Friday, October 13, 2006

Caterpillar, Inc. (CAT)

Beautifully playing with Fibonacci levels, Dow 30 component Caterpillar is attempting to breakout from a 6-month downtrend. Should the current “Dow to 12,000” bullish sentiment continue, CAT may have a possible 4% to 7% upside.

Overbought Financials (MER, GS, MS)

After a recent strong rally in financials, Merrill Lynch, Goldman Sachs and Morgan Stanley seem much overbought as they hover at their 52-week highs. An entry now into short-sell position for a possible 5% pullback in all three stocks may serve as a low-risk entry. Stop loss: Perhaps a $1 close above their respective current 52-week highs.

Thursday, October 05, 2006

Carnival Corp. (CCL)

Global cruise vacations operator Carnival is currently looking overbought. Today’s session closed just shy of the day high $48.75. This level has served as resistance and support before; a short position at current prices for a target towards the uptrend support may provide a low risk entry should this level act as resistance once more. Stop loss: close above $50. Matrix Research has downgraded Carnival from Hold to Sell.

Subscribe to:

Posts (Atom)