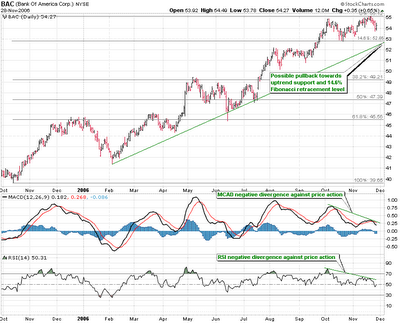

Bank of America has recently surpassed rival Citigroup to become the largest US retail bank in terms of market capitalization valuing the firm at $243.71 billion. An 11-month uptrend has seen stock price rally some 40% hitting new all-time highs. However, the recent all-time highs in price action have been occurring with declining RSI and declining MACD; -implying a bearish negative divergence. An initial price target for a short-sell position would be at the 14.6% Fibonacci retracement level coinciding with the uptrend support. On break of the trendline, other levels of support may include $52 and the 38.2% Fibonacci level. Stop-loss: close above $55.

No comments:

Post a Comment